GST has been set at zero from 1 June 2018 to be replaced by a Sales Tax on 1 September 2018. Existing tax codes EP GP NP and RP will be removed from ABSS internal tax code list for newly created data file.

Implementation Of Goods And Service Tax Gst In Malaysia Yyc Goods And Services Goods And Service Tax Malaysia

It is now available from GST Code Select from List.

. GST Amendments Written by Stanley K Wong Hits. Sales and service tax SST has been doing well in Malaysia before it was replaced a few years back. 30062022 Deferment Of Service Tax On The Goods Delivery Service Implementation.

If You GST-TAX-CODES are OK then Instantly Generate your Return. If your products are non. NOT Sure of the TAX-CODES.

Latest GST Guidelines Published by RMCD - Dec 22 2015. Mapping sales tax reporting codes to sales tax codes. 102020 Pindaan No2 Malay Version ONLY More.

Malaysia are taxed at 19 on chargeable income up to RM 500000 with the remaining chargeable income taxed at 24. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018. GST non-compliance is widespread among SMEs in Malaysia 40 of.

RM 298 - per person price inclusive of 6 GST Special offer for Early Bird Registration. For purchases with input tax where the GST registered entity elects not to claim for it. Basically all taxable persons will be required to account for GST based on accrual invoice basis of accounting ie.

AutoCount Accounting Malaysia GST Hands-on Training Manual by Peter 2 Contents 1. You must use the Default report layout for your reporting codes. Let Our Rule-Engine Suggeest to you a TAX-CODE From Our Unique Knowledge-Base.

GST in Malaysia employs the use of tax codes Approved tax agent under Section 170 of the GST Act 2014 Deputy 7th July 2014 Open for GST agent license application Overview The Goods and Services Tax. Setting Default Tax Code 13. GST Audit File GAF New tax code ICG is available in ABSS tax code list.

Configure Malaysia GST 9 42. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. It stands for 10 percent for sales tax while service tax will be charged 6 percent according to the new release from the finance ministry.

Dasar Cukai Perkhidmatan Bil. You need to fill in the fields as shown especially the tariff code default tax rate if your products are taxable. Update Company Profile 8 4.

RM178 per person price inclusive of 6 GST 3. However certain categories of taxable persons may be allowed to use the payment cash. GST Latest Developments and Compliance Workshop.

Rate could go up to 35 in the whole of 2019. All output tax and input tax are to be accounted and claimed based on the time when the invoice was issued or received. How to Print Air Asia Tax Invoice for GST Malaysia Input Tax Credit Written by Stanley K Wong Hits.

Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018. A a taxable supply standard-rated or zero-rated. Malaysia GST Reduced to Zero.

Just Check that Transaction Type Tax-Rate and Transaction Amount are ACCURATE. NOTIS PEMAKLUMAN BERKENAAN PORTAL MyGST. 29062022 Extension Of Payment Date For Phase 1 Of Special Programme On Indirect Tax Voluntary Disclosure And Amnesty VA.

No specific report layout has been introduced for Malaysia GST. Segala maklumat sedia ada adalah untuk rujukan sahaja. Tax code mapping for gst related transactions and gst accounting entries are new to most of the accounting personnel in malaysia.

5595 Pokemon in GST System Changes. RM 199 per person price inclusive of 6 GST Group Promo 2 Pax Registration. Tax Code Maintenance 9 41.

There are 23 tax codes in GST Malaysia and categories as below. GST 3 Return Reports. GST Tax Code Changes.

Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. As the number of tax codes is increasing it is necessary. Currently stands at 325.

Before values can be calculated and shown on reports you must specify a relevant sales tax reporting code for each tax code that is used in the sales tax payment. It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018. GST Tax Code Changes New purchase GST code IM-CG 6 has been introduced by RMCD for Importation of Capital Goods with GST incurred.

GST was only introduced in April 2015. SST was officially re-introduced on 1 September 2018 replacing the former three-year-old Goods and Services Tax GST system. From 1 june 2018 the rate of the goods and service tax gst will be reduced to 0 from.

Activate GST Malaysia 5 The use of GST Setting From Other Account Book 7 3. A year in review latest updates on business tax audit Perspective everything. Overview of Goods and Services Tax GST in Malaysia.

2 Morning session GST Tax Agent by MoF. A a taxable supply standard-rated or zero-rated. Update of for supply and purchase GST tax code.

If all OK System Generates a Filled-Up. 3104 Consolidated Tax Codes Mapping to GST-03 Written by Stanley K Wong Hits. Review Process Data.

For more information regarding the change and guide please refer to. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300.

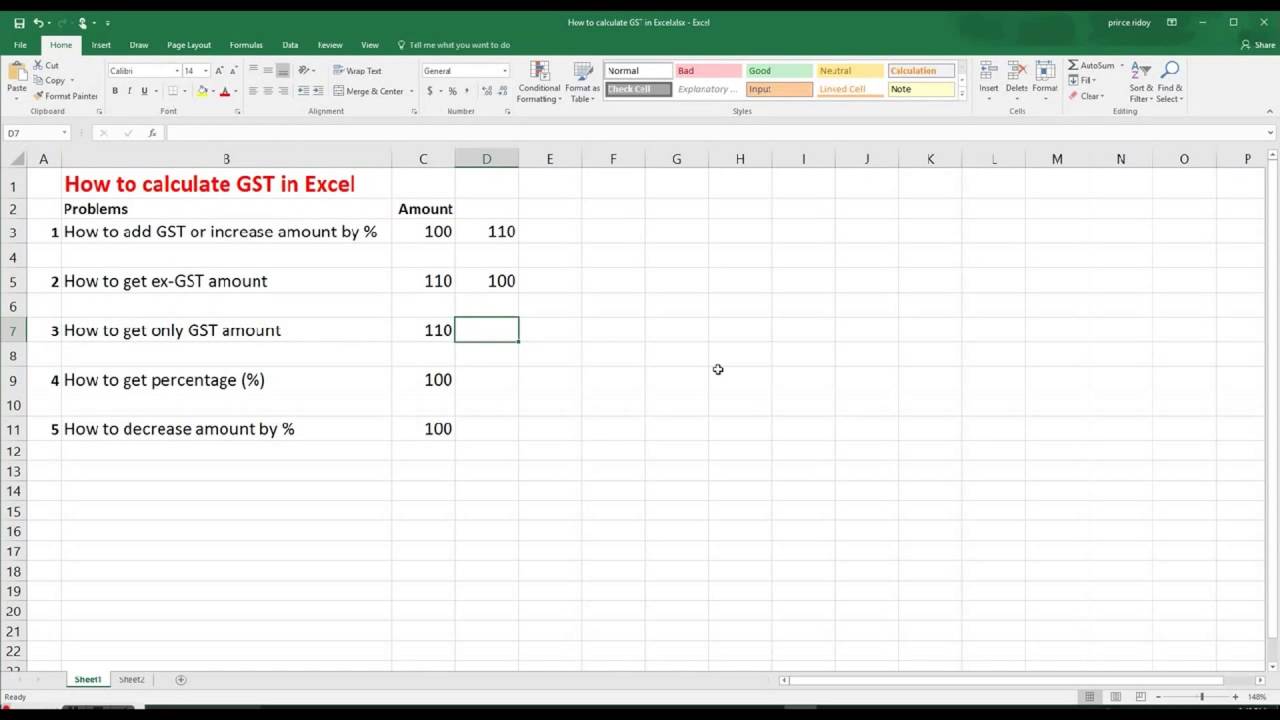

Excel Tutorial Formulas For Calculating Gst At 15 Youtube

Import Goods That Have Gst Finance Dynamics 365 Microsoft Docs

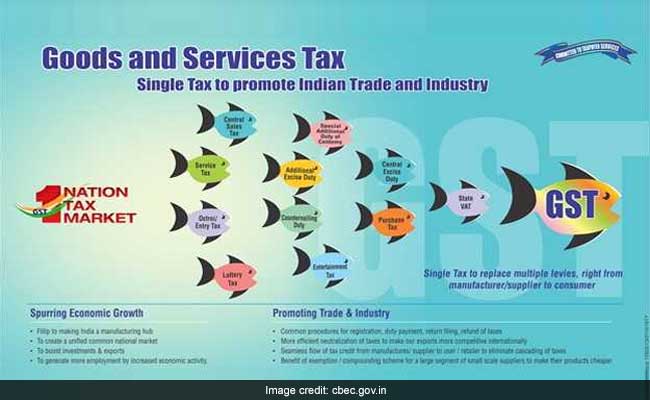

Gst To Subsume Sales Tax Vat Service Tax And Much More Details Here

Ezee Imenu Digital Restaurant Tablet Menu Menu Restaurant Hotel Management Hospitality Management

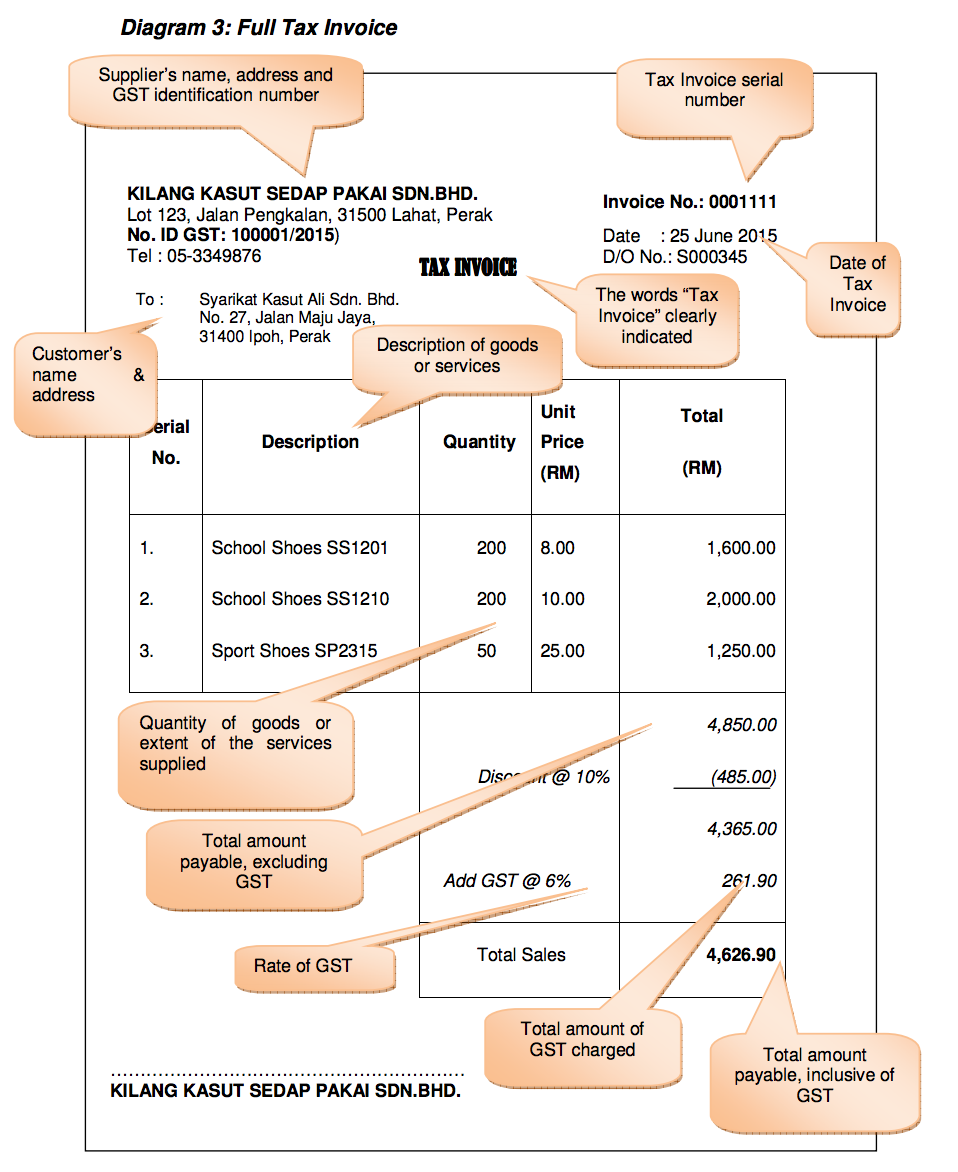

Basics Of Gst Tips To Prepare Gst Tax Invoice

The Brief History Of Gst Goods And Service Tax

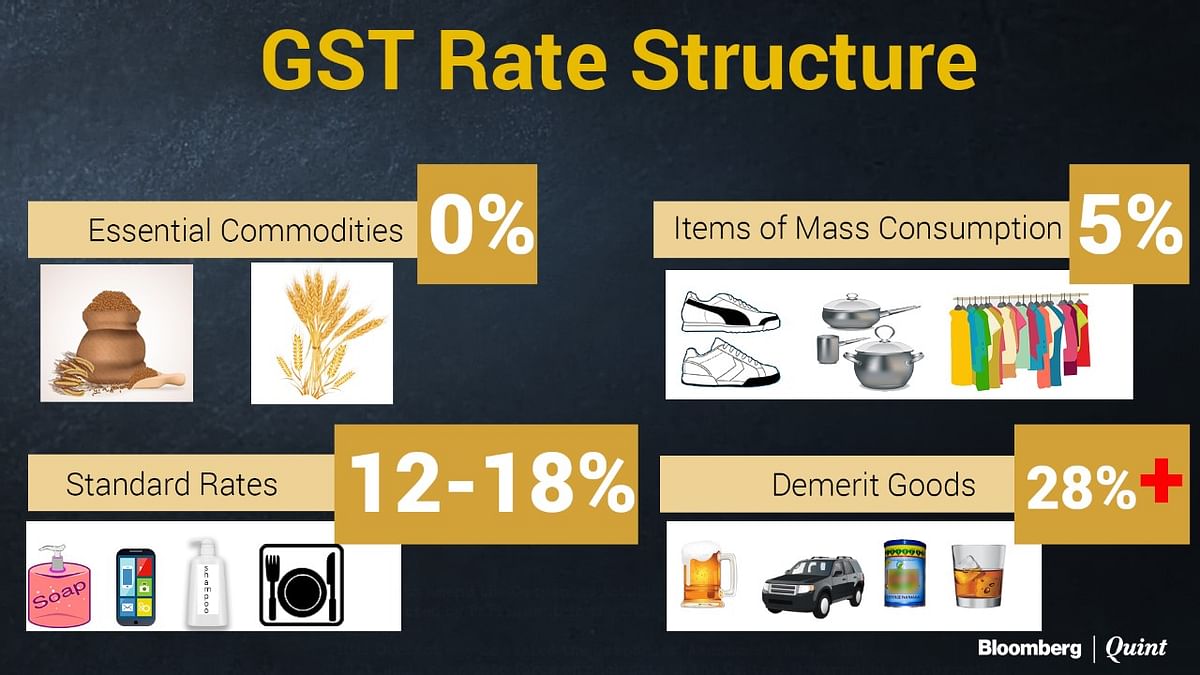

Gst Rates 2022 List Of Goods And Service Tax Rates Slab Revision

Basics Of Gst Tips To Prepare Gst Tax Invoice

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Filing Of Gst Return Video Guide Youtube

Gst Rates In 2022 List Of Goods Services Tax Rates Slabs And Revision

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

Gst Rates In Malaysia Explained Wise

Pdf Goods And Services Tax Gst Transition To Sales And Services Tax Sst Impact On The Welfare Of B40 And M40 Households In Malaysia

India Gst The Four Tier Tax Structure Of Gst

How To Manually Adjust The Gst Amount When Creating A New Spend Money Or Bill